The Serious Concerns About the Gender Pension Gap

Source: WUNRN – 11.05.2018

Women across the globe have 30-40% less money than men in retirement – despite often living longer. Image: Reuters/Nacho Doce

Stephanie Lane – March 7, 2018

It is widely accepted that a gender gap exists. The World Economic Forum’s 2017 Gender Gap report reveals that it will take 217 years to completely remove the disparity between the sexes around the world.

Less well known is the looming $400 trillion retirement crisis highlighted in the Forum’s 2017 paper, We’ll live to 100 – how can we afford it?. This post explores the intersection of these two issues and the steps that can be taken to help close these gaps.

Even though the problem is wider-reaching, when we talk about the gender gap we often think of the inequality in wages. The gender pay gap is commonly quoted at around 10%-20% in the western world. However, income during retirement – the gender pension gap – is significantly wider.

Women face a number of headwinds both before and during retirement to create a perfect storm, typically resulting in dramatically lower financial security in retirement than men.

The gender pensions gap is estimated at 30-40%

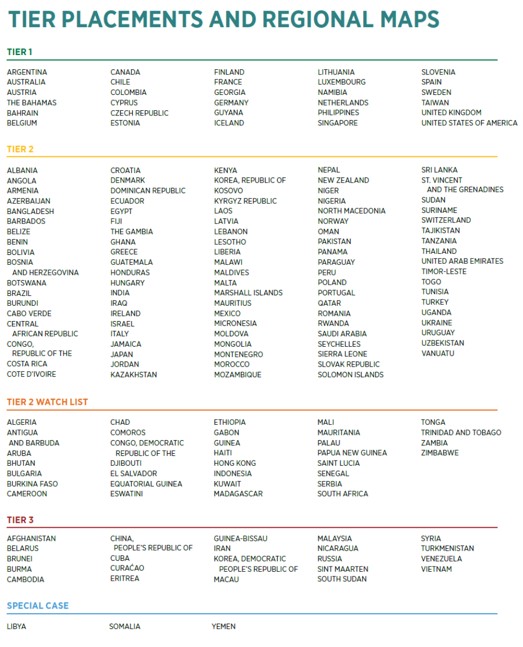

Typically, the balances of women in retirement are 30-40% less than men across the globe. Taking Europe as an example, the gender pension gap varies significantly between different countries, ranging from 4% to 49%, but more than half have a gap of 30% or greater.

The gender pension gap across Europe

Image: Mercer

As a result of the gender pension gap, a third more women are in poverty in retirement than men in European countries (16% vs 12%), with widows along with black and Latina women typically experiencing higher rates of poverty.

So why are women so much worse off in retirement than men? Because they face a perfect storm of challenges.

To start with, women typically need more money for their retirement than men, so have a bigger problem to solve when it comes to saving for retirement. To make things worse, women tend to accumulate fewer savings than men in the years before they retire, making the problem even harder to solve.

Why do women need more money in retirement?

• Women have longer retirements. It’s well known that women generally live longer than men, estimated at 2.5 years longer from age 65 on. This means women will spend more years of their lives in retirement, and so they must target a higher level of savings than men to achieve the same levels of annual income throughout their entire retirement.

• Women will spend more time living alone in retirement. Given that women live longer than men, most women will outlive their husbands. This means that they will likely live alone for a number of years, estimated to be ~4.5 years in the US, without anyone to share expenses.

• Women’s retirement needs are more expensive. Finally, women typically spend more on healthcare (~7% a year in the US), and are less likely to have a spouse to care for them in place of professional caregivers.

Why aren’t women saving as much?

• Women save for a shorter period of time. It’s not news that women participate in the workforce for fewer years of their lives than men on average, as they are more likely to take breaks to start a family or care for sick relatives, or both. In the US, women participate in the workforce just 75% of the time that men do and are almost twice as likely to be a part-time worker. Given that most people set savings aside during their working years, gaps out of the workforce make it hard for women to keep pace when it comes to accumulating savings.

• Women save smaller amounts each month. While incomes for both men and women have been increasing at a global level, there has been more of an improvement for men than for women, meaning that the gender pay gap is widening. Given that women typically earn less than men, they will be saving less during their working lives and also receiving lower matching contributions from employers. And it’s not just the pay gap within the same roles that is driving lower earnings for women. The type of jobs held by women are typically lower-paying than those held by men, which acts as a barrier to career progression and pay equity; for example, less than a quarter of people in senior managerial positions are women. In certain more casual, lower-paid roles, women may not even qualify for entry into company pension plans, meaning that their contributions are not just smaller but nonexistent.

• Women take fewer risks with their investments. Research by consultants Mercer indicates that women have less financial courage and are less confident about their financial security in retirement then men. This means they are less confident about taking control of their finances and tend to take fewer risks when it comes to choosing investment funds. As a result women are less likely to choose aggressive, growth-targeted strategies and will miss out on opportunities for long-term growth. If a divorce should occur later in life, a woman who has been absent from the workplace will be less able to build up replacement savings than her male ex-partner.

A graph showing male and female investment behaviour

Image: Mercer

What can we do?

• Recognize our differences. Planning for retirement should look different for women and men given the different life cycles. If women follow the same retirement plan as men, they will fall short in retirement. Retirement system providers should target women differently, give women confidence to handle their finances and consider different, perhaps riskier, investment strategies. Employers should review their benefits systems through a gender lens, to ensure options and communications meet the needs of both sexes.

• Acknowledge time spent out of traditional workplaces. Governments and employers should consider ways to recognize the time individuals (both male and female) take out of the traditional workforce to contribute towards society (eg in the form of pension credits) and remove any structural barriers to catching up on any lost years of contributions (eg tax limitations).

• Be prepared for future disruption. The Fourth Industrial Revolution is expected to disproportionately affect women; twice as many jobs dominated by women are expected to be replaced by robots than jobs held by men. Employers should understand how their workforce is expected to evolve and identify jobs at risk of technology disruption and any associated opportunities for reskilling and adjacent careers.

• Encourage financial inclusion and independence. As suggested in the title of a paper produced by the Australian parliament, A husband is not a retirement plan, many women around the world rely on their husbands to deal with the finances and to provide retirement incomes. This backfires in the event of divorce, when retirement balances are not split to reflect any sacrifices made by women to support the family. In many developing parts of the world, the problem is even more acute, as many women do not have access to the financial system. Governments should find ways to provide easy access to banking and savings products, perhaps utilizing advances in technology (eg digital national IDs and mobile banking) to reach under-served pockets of society, including women.

Closing the gender pension gap will require cooperation from governments, employers and individuals, male and female together. As with most problems, the first step is to acknowledge the problem exists, but secondly we must learn from others’ experiences and take action to reshape the future of long-term savings for women. Only by committing to this goal and working together can we fully close the gender gap.

World Economic Forum

https://www.weforum.org/agenda/2018/03/retired-women-less-money-pensions-than-men/